News & Events

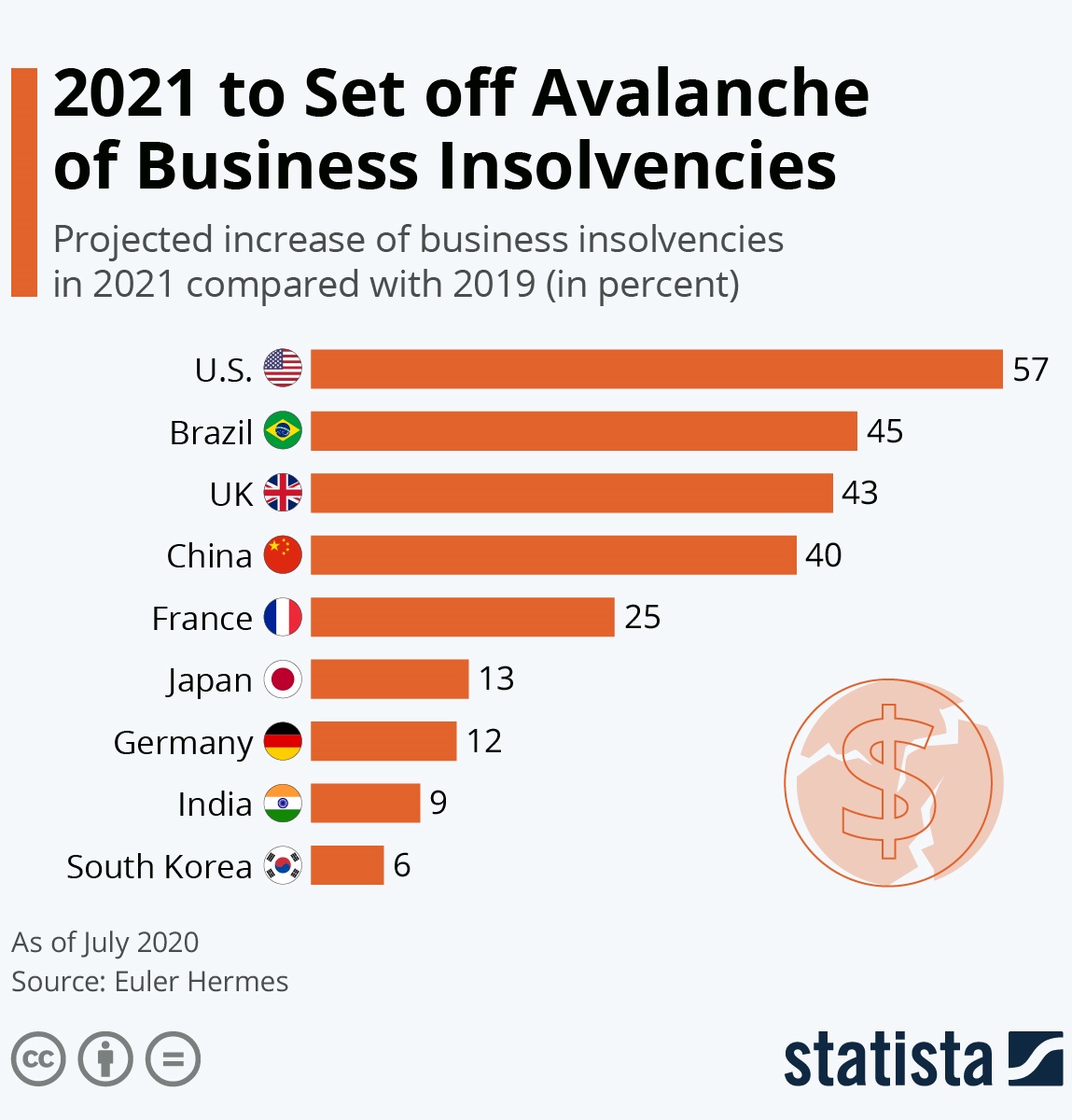

Lynx Global warns; 2021 will set off an avalanche of business insolvencies

December 5th, 2020

* A business insolvency is when a company is no longer able to pay debts or bills.

* It's predicted that 2021 could bring an avalanche of business insolvencies as the effects of lockdowns on businesses take hold.

* In the United States, business insolvencies are predicted to rise by 57% as a result of Covid-19.

According to a report by insurer Euler Hermes, the effects of the Covid-19 pandemic will be felt most severely in 2021 when it comes to business insolvencies. The number of insolvencies will rise sharpest in the USA (up to 57% more compared with 2019), Brazil and the UK.

China is also expected to be hit hard. Since many countries stopped requiring businesses which are insolvent to file for insolvency during the pandemic, the real cost to businesses will only unfold much later. Insolvencies are expected to actually fall as a result of these regulations in 2020 and pile on in 2021.

Less of a burden is expected to be felt in Germany, where insolvencies are expected to be up by 12% in the coming year. Ron van het Hof, CEO of Euler Hermes in Germany, Austria and Switzerland, expects that the calm before the insolvencies storm will be over in the third quarter of 2020.

"This time bomb will go off in the third quarter of the year at the latest and the shock waves are likely to spread into the entire first half of 2021", van het Hof said.

Developed economies in East Asia, for example Japan and South Korea, will experience significantly fewer insolvencies as they avoided large scale and prolonged shutdowns. India, which is now the second hardest-hit country in the pandemic, is expected to also get off quite lightly.